12/15/22

Top food delivery trends to watch in 2023

Written by Christopher Stanvick

As we move into 2023, the food delivery industry is expected to continue to evolve and innovate in new and exciting ways.

As consumers become more conscious of sustainability and convenience, we can expect to see a focus on eco-friendly options, the continued rise of ghost kitchens, and the integration of AI and automation. These trends will make it easier and more convenient than ever for customers to enjoy their favorite meals at home.

Sticky habits like remote work and contactless delivery are, in all likelihood, not going anywhere soon. This combined with the overarching trends of inflation and shifting residential markets, means there is more pressure than ever on building owners and managers

So, as we move into 2023, there are a few top food delivery trends that building owners and property managers should watch closely. As far as contactless delivery is concerned, we have a few educated predictions.

Last-mile grocery delivery will continue to increase in demand and popularity

Advances in technology, an increased desire for personal distancing, and the ever-increasing population of cities have fueled a fundamental change in the way people buy groceries.

- The global market for online groceries grew from $285.7 billion in 2021 to $354.28 in 2022.

- At a predicted growth rate (CAGR) of 25.3%, the dollars generated from online grocery purchases alone would exceed $2.15 trillion by 2030.

The bottom line is even if the growth rate is more modest than experts predict, the market for grocery delivery will grow in 2023. More and more people are becoming familiar with (and subsequently developing a preference for) shopping for groceries via online channels—and when you consider the unparalleled convenience offered by these platforms, it’s not hard to see why.

Add to that the appeal from a health and safety perspective, and that 25% annual growth rate seems unsurprising.

Another interesting subset of online grocery delivery to keep an eye on is the market for subscription-based meal prep services.

- Industry analysts predict that – at a compounded annual growth rate of 13.9% – the market for prepared meal delivery will expand from $11.68 billion today to $19.64 billion by 2026.

- This market growth is largely being spurred on by consumers’ increased demand for subscription services.

The forces propelling the market for online grocery delivery to new heights are numerous and persistent. In 2023 and beyond, it’s more than safe to say that demand will not slow down, which is why it will become increasingly vital to implement systems for handling orders, helping workers, and satisfying customers.

What does this mean for building owners? More and more people want fresh, affordable foods delivered to their homes, and building owners need to offer an easy way for that to happen. A simple-to-use food delivery management (FDM) solution may be key to simplifying the grocery delivery process for residents and tenants today, and in the months (and years) to come.

1. Demand for delivery technology and food delivery management solutions will keep growing

The market for food delivery has grown, but it’s also experienced some growing pains. The explosive increase in the volume of online orders that buildings, businesses, and third-party services have had to handle has been challenging to say the least.

However, out of this adversity, a wave of innovation has occurred. New technologies have emerged to reduce the burden placed on drivers, restaurants, and the properties that they deliver to.

At first, there was a panicked scramble to set up new systems for handling delivery orders. But fortunately, over time, these DIY solutions have been refined and standardized to be more sustainable and efficient.

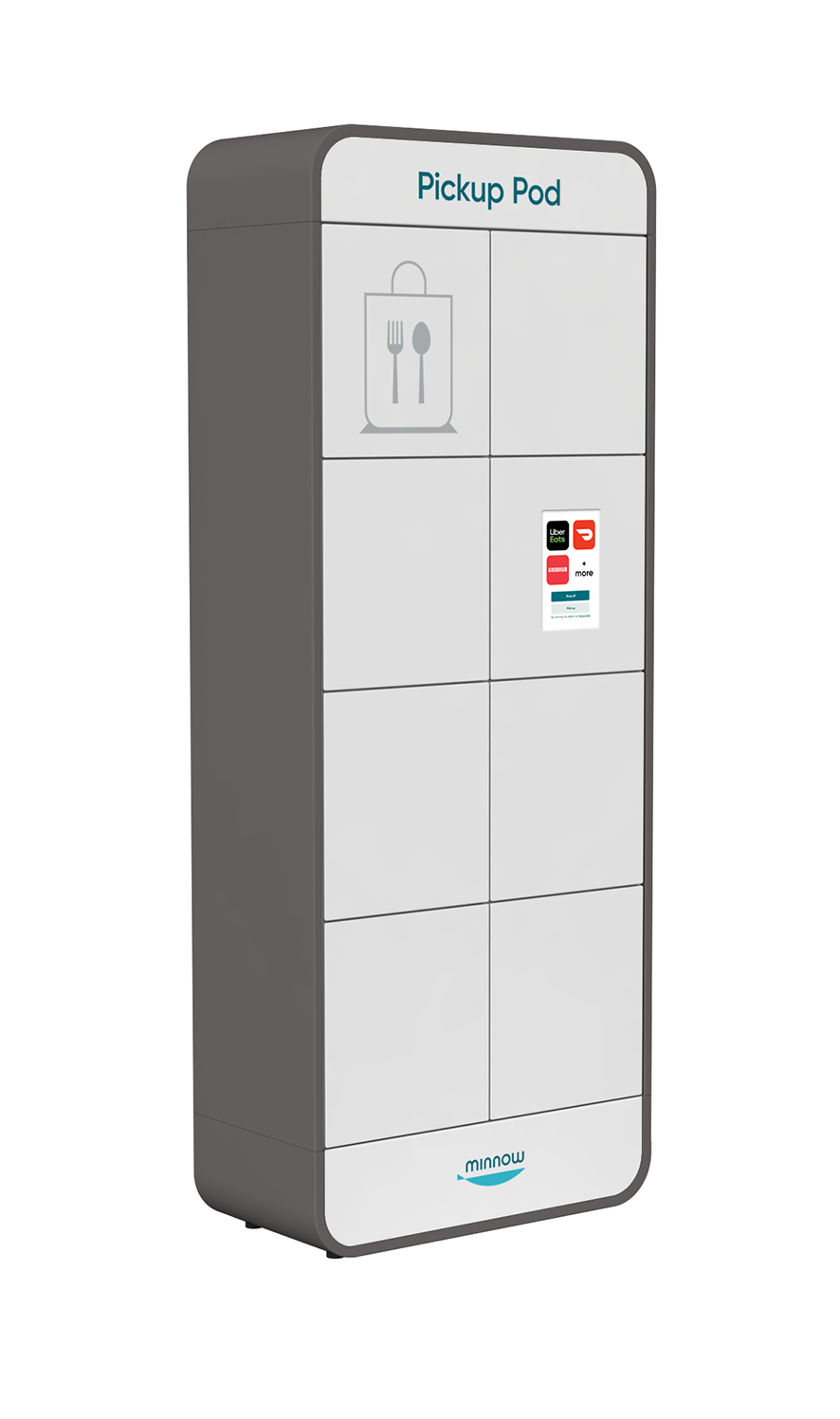

Smart food lockers have replaced shelves, restaurants have set up new kitchens exclusively for mobile orders and building managers have incorporated delivery service coordination into their employee training.

2. Data collection & optimization will be key for foodservice operators, property managers, and residents

As demand for food delivery continues to increase, these technological and operational innovations will continue to become more refined and advanced.

Many of these new tools come equipped with data-rich technologies that allow businesses to track and analyze customer trends and behaviors. This data can be used to improve and evolve the way that they operate.

Knowing what times of the day are busiest, what menu items are most popular, and how long it typically takes a delivery to be completed are just the tip of the iceberg when it comes to utilizing user data.

As technologies become more advanced, so will the quality and variety of the insights that they provide. And it’s yet another reason for building owners and managers to invest in technological amenities that have the capacity to provide data.

3. Consumers will continue to opt for hyperlocal food options

Ordering food online can feel slightly impersonal. The experience of patronizing a local establishment is hard to replicate via a mobile app. That’s why, for consumers who want the convenience of contactless delivery but still want to support their neighborhood eateries, the ability to support hyperlocal ordering will be key.

They may not feel like leaving their apartment, but they can still get their familiar favorites delivered. This way, they get the satisfaction of supporting businesses in their community while staying safe and comfortable at home.

For this same reason, more FSOs may explore and opt for direct-restaurant delivery, either in combination with or as an alternative to third-party delivery services. Giving as much business as they can to the restaurant itself will provide a similar sense of local comradery and cohesion.

That’s why it’s crucial for building owners to adapt their food delivery management policies to accommodate a wide variety of delivery services and processes. Without a single, streamlined way to collect and hold these deliveries for consumers to retrieve, there’s a big risk that every delivery will be handled a little differently—and that could have negative consequences.

With a single, simple-to-use FDM solution in place, building owners can feel confident that residents and tenants can order food from their favorite local spots with minimal mess or confusion.

4. Rising food costs will push consumers to seek out more affordable food options

Thanks to inflation, groceries and restaurant meals have become more expensive.

- Today, supermarket purchases cost 12.4% more than they did last year, and restaurant food is 8.6% pricier.

- This is markedly higher than past year-over-year increases, causing concern among consumers which has led to frugality.

We can’t know if the rate of these price hikes will persist into 2023, but we do know that the current state of the market has caused people to seek out more affordable options where they can find them and cut down on impulsive spending.

This doesn’t necessarily mean that people will order less food, but it may influence the nature of what they order. For example, households worried about frivolous spending may order less from restaurants, but they may instead order groceries in bulk for delivery.

Either way, building owners need to be able to accommodate shifting habits and preferences among resident and tenants. With a smart FDM solution in place, property owners and managers can move forward with confidence knowing residents can choose more affordable and healthier food options without running the risk of a worse food delivery experience.

5. Specialty diets and food preferences will continue to dominate

Nutritional science is hot right now, and it doesn’t show any signs of cooling down. The fact that 44% of American consumers consider the ingredients in their food “a lot” is one strong indicator.

The precise reason for this rise in nutritional awareness is hard to pinpoint, but a general increase in health consciousness is certainly at play.

- During the pandemic, one survey found that 34% of American consumers were seeking out more foods that provided health benefits or strengthened their immune systems.

- One key indicator of the popularity of “specialty diets” can be found in a 2022 study that showed that only 4% of American adults avoid gluten because they medically need to while 13% avoid it simply because they want to.

- Additionally, 38% of young adults (18-24) said that they were interested in starting a gluten free diet. The most surprising finding from this study was the fact that adults who avoid gluten for non-medical reasons were actually more likely to stick to the diet than those who actually had celiac disease.

The key takeaway of all this is that the modern consumer, eater, and resident is highly cognizant of their diet. For building owners, that means there is more pressure than ever to provide food delivery processes (and FDM solutions) that cater to their specific needs. Those who chose to ignore the trend may find residents simply choosing elsewhere to live in the years to come.

Is your property ready for what 2023 has in store for food delivery?

For most building and property owners, these emerging industry trends will not have come as a surprise. In most cases, they probably witness them firsthand every day.

An increased demand for online ordering options and an enduring desire for contactless delivery have been a part of the residential experience equation for years now.

The paradigm shifts in the way that consumers buy food and approach the ritual of mealtime post-2020 are unlikely to be reversed any time soon. If anything, these sticky habits will only burrow deeper into residents’ preferences and needs in 2023.

So, if you’re interested in joining the community of innovators and leaders who are getting out ahead of these changes and implementing systems to handle them more efficiently, the Minnow Pickup Pod may be exactly what you’re looking for.

Get in touch with our team to learn more about how our smart FDM solution can help meet the needs of residents and tenants today, tomorrow, and through whatever the future has in store.